Viking is expanding its ocean fleet by two in 2029 after exercising options for new-builds with its shipbuilder. The firming of the arrangement means Viking will have eight ships on its order books from 2024 through 2029, along with two more options flagged for 2030.

Viking Vela and Viking Vesta will be delivered this year and next, with two yet-to-be-named ocean ships in 2026, another one-a-piece in 2027 and 2028, plus these latest confirmations.

Viking also confirmed it expects to take delivery of two river ships this year.

Subscribe to LATTE Cruise’s free eNewsletter to keep up to date with everything in the luxury cruise space.

The updates were revealed in Viking’s first quarterly earnings presentation after going public and listing on the New York Stock Exchange this month.

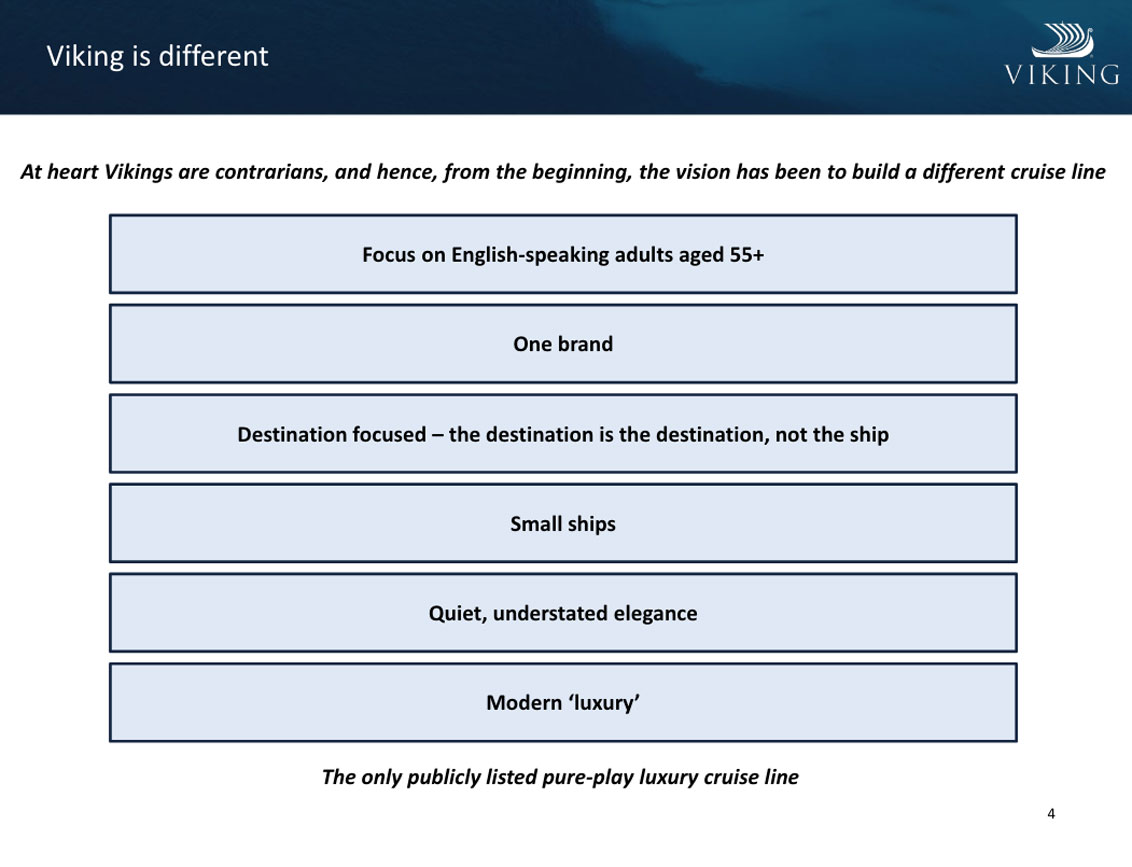

In the presentation, Viking refers to itself as “the only publicly listed pure-play luxury cruise line”. That phrase is based on the brand’s key selling points: target audience, brand, destination focus, ship size, quiet and modern ‘luxury’.

Viking reported that as of 19 May 2024, for the 2024 and 2025 seasons, it had sold 91% and 39% respectively of its Capacity Passenger Cruise Days for its Core Products (Viking River, Viking Ocean, Viking Expedition and Viking Mississippi). Its adjusted gross margin for the first quarter of 2024 increased 19.1% compared to the same period in 2023.

Total revenue for the first quarter of 2024 was US$718.2 million, an increase of US$89.2 million (or 14.2%) over the same period in 2023. The spike was cited based on an increase in the size of the company’s fleet and higher occupancy in 2024 compared to 2023.

Commenting on the result, Torstein Hagen, Chairman and CEO of Viking said, “At Viking, we remain committed to prioritising our guests and treating our employees as integral members of our family.”

“We embrace a contrarian approach and steadfastly maintain a long-term perspective when managing our business. Leveraging our momentum, we are dedicated to shaping Viking’s next era to deliver value for all of our stakeholders,” Hagen said.

Occupancy on Viking’s river ships was down 1.4 percentage points to 92.1% during Q1 2024, however net yield was US$609m compared to US$593m on the year prior. Viking Ocean occupancy was up 0.6 percentage points to 94.5% as net yield also grew from US$425m to US$439m.

Further, Viking noted that its Ocean 2025 Advance Bookings to-date are 30% higher than the 2024 season at a like-for-like time in 2023, driven by an increase in passenger volume and pricing.

To date, 47% of Viking’s Ocean 2025 capacity has been sold, while 30% of the cruise line’s 2025 River capacity is sold.