At Virtuoso Travel Week, a panel of luxury travel advisors brought up the trend of shifting brand loyalty dynamics. Notably, Bharti Keshwala, partnerships director – Global Elite & Luxury, Reed & Mackay Travel, in the U.K., said that her clients are increasingly less loyal when it comes to the airlines they book with.

As airline keep “moving the goalposts” when it comes to the requirements for earning top status levels (making this much more challenging for all but the most frequent of flyers), travelers are more willing to forgo their preexisting loyalties and, instead, are opting for whichever airline can provide the best value.

On the topic of some travelers spending less on airfare, Keshwala explained that “airlines keep moving the goalposts on their loyalty programs, and that, now, impacts the way people travel.”

This sentiment was echoed by Chris McIlroy, travel designer and managing director of Travel Inspirations, in Australia. She said, “We’re seeing clients, rather than chasing miles or status, they’re actually going for the value on airfare.”

Subscribe to LATTE’s free eNewsletter to keep up to date with everything in the luxury travel industry.

Added Eli Wagner, founder of Wagner Bespoke Travel, an affiliate of Coastline Travel, in California: “We’re absolutely seeing travelers re-evaluate loyalty. For years, airline programs dictated decision-making, but with shifting goalposts and diluted benefits, clients are far more focused on value. If the schedule, experience or price isn’t right, they’re quicker to branch out from their usual airline.”

Skipping Commercial Airlines Altogether

In a separate conversation LATTE had with Beth Washington, founder of Getaway Guild, an affiliate of SmartFlyer, Washington agreed with the panelists.

While noting, “there’s always going to be a group of people that are super loyal—whether it’s the airline the hotel,” she said many clients are more interested in booking whichever experience will be best for the price they want to pay. So, instead of booking with their typically preferred airline, they are more often booking whichever plane is best or wherever they can get the best seat.

Other travelers, said Washington, who would typically fly in first or business class are opting for semi-private flights given the increasing cost of commercial airlines. For a comparable price, they can enjoy a much better experience without the hassles of typical commercial air travel.

Washington also noted that with so many credit cards offering loyalty programs that are airline agnostic, clients are simply happy to use these points rather than those they accrue with a given airline. Additionally, with flight and hotel capacity nearly full across the board, clients are learning they cannot rely on receiving their complimentary seat or room upgrades through their status. So, now, they are just booking the better option from the start.

“People are sick of feeling trapped by their airline loyalty,” Washington said.

Does This Translate to Hotels, Too?

While the answer isn’t as cut-and-dry when it comes to hotels, Virtuoso advisors see more willingness among their clients to branch outside of their typical comfort zones.

“Hotels are a bit more nuanced,” explained Wagner. “Brand affinity is still strong when travelers feel genuinely recognized, but record-high ADRs have made people more discerning. Keep in mind that value isn’t about the lowest rate; it’s about the best overall experience for the spend.”

Keshwala, however, said she is seeing more travellers opt for new hotel brands. “As ADRs continue to rise, luxury leisure travellers, in particular, are becoming less focused on brand loyalty and more attentive to the actual value and experience a property delivers,” she said. “While points and status still hold some appeal, clients are more inclined to explore new hotel options if they promise a unique or elevated stay experience.”

For example, Keshwala explained that “rather than defaulting to a traditional five-star chain, a traveller may opt for an independent luxury resort that offers expansive suites with private plunge pools, locally inspired design and curated cultural programming—things that create memorable moments and feel more tailored than a standard loyalty benefit.”

In short: “The differentiator is no longer just the rate, or the points earned, but the sense of exclusivity, personalisation and enrichment the property can offer.”

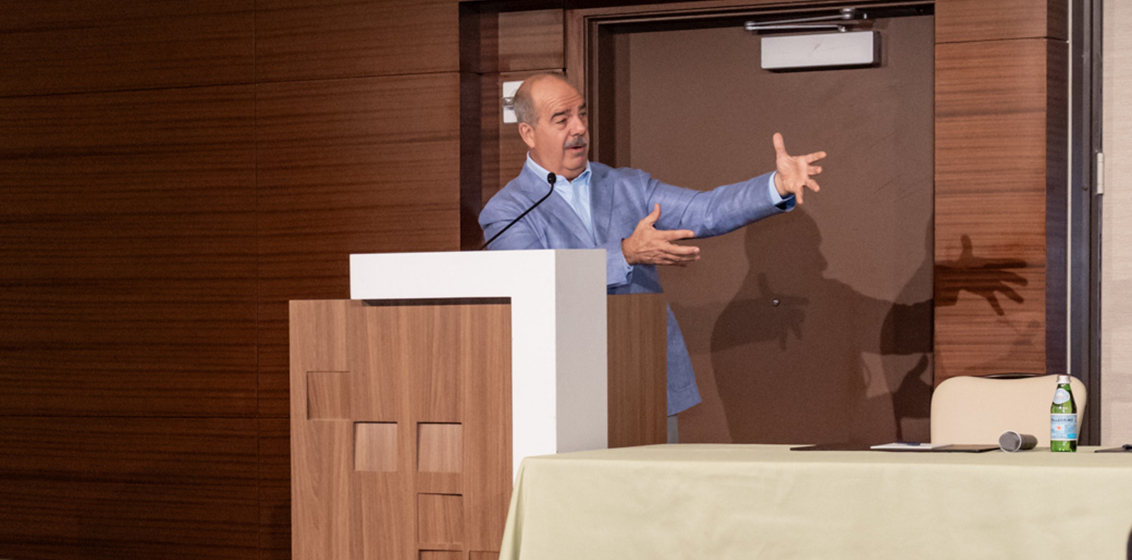

To Consider: The Hotel Owner

Separately, Virtuoso Chairman and CEO Matthew Upchurch spoke to the media about the challenges that many luxury hotel brands are facing: ownership. While each brand has a set of standards it holds its individual owners to, some owners are more involved and committed to upholding—and even elevating—these standards. This, therefore, makes it a challenge for advisors (and their clients) to know what they can expect from a given property.

For this reason, Upchurch said, advisors are caring more and more about the owner of the properties they send their clients to.

Upchurch added, without mentioning any brands, that some are looking to change their fee structure for owners to use their brands based on their involvement. This could further diverge the level of service you receive at one hotel compared to another of the same brand. He also mentioned one case—again without mentioning the brand or property—of the global brand de-flagging a specific property for failing to uphold brand standards. Upchurch called this great news, but this seems more of a reaction than a proactive effort.

If you ask any luxury hotel GM, said Upchurch, the thing that best enables them to do their job is their ownership.

With hotels increasingly opting for an asset-light approach, instead choosing to franchise out their names to owners and developers, it could become increasingly difficult to maintain high standards at each property. Could this further deteriorate brand loyalty?